A long, bitter, expensive exercise. Continue reading

Documentation: I found a folder that contained a large number of documents concerning the attempt to sell the company. Some of them were in legalese, and some were very long. In most cases when they were germane to the story, I have included links to pdf files posted on Wavada.org.

I did not find any emails or notes about meetings. I have therefore needed to rely on my memory, which never had infallibility attributed to it at the First Vatican Council or anywhere else.

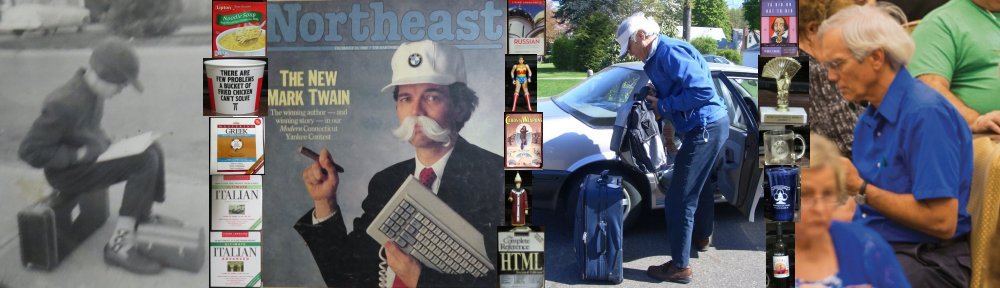

The plan: I had often thought about selling TSI, but I could never visualize how it could happen. In 2005 my partner Denise Bessette (introduced here) mentioned in one of our private meetings that she was interested in trying something different, perhaps in academia. We decided to investigate the possibility of selling the business. We were by no means desperate to do so. We were both earning six-figure salaries in those days. So, we were not going to forgo them unless the money was good. Also, we had a substantial backlog of profitable approved projects, and a new product, AxN, that was doing better than we had expected.

We agreed on two primary criteria for any sale. Denise would not be an employee of the new company after she sold her shares. Since I could not imagine why anyone would want TSI without both of us, the second criterion was that my role in the company after the purchase would be temporary.

From the outset I was skeptical of the likelihood of selling the company under those circumstances. It seemed to me that unless there were some demonstrable synergy between either AdDept or AxN and a prospective buyer’s product or service, I could not see the value of what would be left of TSI after both criteria were imposed.

I had informed my wife Sue, the other share-owner of TSI, that we were planning to explore selling it. When I told her that we hoped to get over $1 million for it, she was all for the idea.

Retaining a broker: Somehow we determined that it was necessary to engage a business broker to help us find a buyer. The fact that we had experienced very little success working with third parties other than IBM contributed to my pessimism. Nevertheless, I composed a very long letter that we sent to a few brokers who specialized in businesses like ours, or at least they did not specialize in much larger companies or vastly different industries. I do not remember where we obtained a list of appropriate brokers.

I have posted here a copy of the one that we sent to Steve Pope in March of 2007. He was not the first person to whom we mailed the letter. Here is a list of the brokers that we mailed to:

- The first letter was sent to William Gunville2, the president of Successions, Inc., in East Weymouth, MA, on March 31, 2006. I found no evidence that he or anyone at his company responded.

- The second letter, sent on the same day, went to Kerry Dustin3 of the Falls River Group in Naples, FL. There is no indication that he responded either, but the file does have TSI’s financial statement dated April 8 in three different formats.

- On April 28 I mailed four letters. The first went to Merfeld and Schine, Inc., in Boston4. We must have had some subsequent communication with them. I have a copy of a blank agreement that someone at the company evidently sent to me in August.

- I do not remember ever conversing with Matthew Lerner of Newport Acquisition Services5 of Columbia, MD.

- No one from the Catalyst Group6 in Boston responded to the letter.

- The last of the April letters went to the Corum Goup, Ltd.7 in the state of Washington. I remember one telephone call that might have been with someone from Corum. The gist of it was that even though we might have found a niche that provided the principals with comfortable incomes, that did not mean that anyone would be interested in buying the company. The man on the phone said that this was quite common. This, of course, confirmed what I had previously thought. This same person also said that the most likely company to be interested in purchasing us would be a competitor. The fact that we had no real competition was therefore a disadvantage!

- On May 2 I sent a letter to Bob Capozzi of VR Business Brokers8 of Milford, CT. If he responded, I have no record of it. He might have told us that we were too small for his company. Several brokers told us that.

- On March 31 of 2009 I mailed the same letter to Robert Meyers of Marshall Business Brokers in Bloomfield, CT. By that time we had worked with Steve Pope for two years. We must have felt that we could do better.

Of all the firms that we contacted Steve Pope was the only person who thought that he could help us sell the business. We met with him a couple of times and talked to him over the telephone quite often.

We signed an agreement with him that cost us $1,000 per month for two painful years. I have posted a copy of it here. Note that our asking price was $1.5 million.

Both Denise and I found Steve to be pretty easy to work with, and he provided us with a great deal of useful information. We did not know what we were doing when we started this process.

At the time his last name seemed an unbelievable coincidence. For the previous three years I had been researching the history of the papacy (detailed here) in hopes of getting my ideas about the popes published.

The valuation: Steve insisted that we hire an outsider to undertake a professional valuation of TSI. He recommended a man named George Abraham9 and provided us with a write-up of his credentials and approach, which I have posted here.

We had to put together materials for him. Almost all of the information came from our general ledger. This cost us several thousand dollars and, in my opinion, was worse than worthless. It was obvious to me that he had just run information from our G/L through a software program that basically took the retained earnings and added the value of the fixed assets. Our fixed assets were minimal, and, as a closely held company, we had distributed nearly all of our profits at the end of every year. So, he concluded that our company was worth very little.

We considered the value of our company to be in its client list, the relationships that we had established with the clients, the strength of our staff, and the fact that the clients were totally dependent on us. None of this appeared in the valuation. When I complained about this, Mr. Abraham said that all of that was considered “good will”. He could increase it, but the first thing that any prospective buyer did with a valuation was to discard or at least disparage the portion that was attributable to good will.

I felt as helpless in this situation as I did when I had to fill out a “Request for Proposal” form designed by a consultant to use to assess potential software solutions. Those forms seldom allowed me to highlight the parts of our system that would help the prospective client the most. In the same way the valuation was going to be the first thing that a prospective buyer would see, and it did not allow us to highlight what was good about TSI.

Nibbles: TSI rented box #241 at the post office in Warehouse Point for communication that we might receive from Steve or from anyone else involved in the project. I went there every couple of days, take the junk mail out of it, and throw it in the recycle bin. I very seldom brought anything back to the office.10

I remember that a couple of times over the next few years Steve tried to connect us with people who might be interested, but nothing came of any of these exchanges.

I found four documents in which I answered questions about TSI’s approach. The first was a letter that I sent to Steve on January 31, 2008, about the alleged obsolescence of the AS/400, which by then had undergone a few name changes. I have posted it here.

I also have posted answers that I provided to many very detailed questions to people that I don’t remember named Peter, James, and Len. The first two were dated February 4, 2008. The last one was sent on March 14, 2008.

Denise and I were encouraged at first, but after a few months we began to hear less and less. Steve still called once in a while, but there were no prospects who could be considered even lukewarm.

The buyer: Steve told us in early 2010 that an “entrepreneur” from St. Louis who had bought and sold several companies was interested in buying our company. His name was Tim Finney.11

Denise and I had a conference call with him and Steve in early March. Evidently we did an abbreviated demo of our systems via Webex.12 I don’t remember the details, but I found a letter that Tim sent to us on March 15 (beware the Ides of March!) that provided a fairly detailed analysis of what he was willing to pay us for our stock in TSI. It has been posted here. The important features were:

- The total purchase price was $1,000,000 for 100 percent of the stock.

- We would need to pay capital gains taxes on this amount.

- I would work for another two years at a salary of $95,000. He would have the option of extending this another two years if “Tim and Mike agree that the business can or can not sustain itself at that time based on Tim’s progress with the software code/business.” In any case Mike would work for two months for nothing.

- Denise would work for two months for nothing.

We were very interested. On May 7 Tim sent us a confidentiality agreement, which Denise, Sue, and I signed and returned to him. The confidentiality agreement has been posted here.

Tim sent the Letter of Intent a few days later with the specification that the closing would be by July 15, or earlier if possible. I made it clear every time that I talked with anyone involved that I needed for this either to be completed before August or postponed until September. Sue and I had scheduled a trip for August 8 through August 21.

The signed LOI has been posted here.

Tim made a trip to Connecticut in early June after the LOI had been signed. I discovered an outline of what I wanted to say to him. It is posted here. Denise and I met with him on a Saturday or a Sunday. I remember two things from that visit, which seemed to go very well. The first was that Tim said that he had purchase several companies, and had resold most of them. One that he was still holding was a software company, and he mentioned some sort of difficulty with it. The other memorable event was the surprising statement that he would have no difficulties with his banks. He claimed that he had great relationships with all of them. I only had two banks, and no one at either one had any idea who I was.

Both of these should have been red flags. I was already dreading needing to work for Tim for two or four years. If he already had trouble with other coders in a similar position, it might be even worse than I had imagined, and I already imagined myself being screamed at over the telephone on a regular basis,

His mention of the banks made it clear that he had not yet obtained the financing. I should definitely have called a halt to proceeding any further until he had lined up the money. It was a rookie mistake.

The lawyer: Back in April Denise and I could understand that we might be in over our heads. We asked our accountant, Tom Rathbun, if he knew of any lawyers that could help us in dealing with a prospective buyer for our business. He recommended that we contact Mark La Fontaine of the law firm of Andros, Floyd & Miller. We contacted him, and he sent us an engagement letter on April 5 that stated that his billing rate was $300 per hour. He waived the retainer fee.

Denise and I drove to his office one afternoon in April. We explained our situation to him. For some reason he was most concerned about Sue’s status with the company and the fact that she was part of our group health insurance. He strongly advised us to remove her from the group. I disagreed with his assessment. I was quite sure that I could defend our approach if someone accused us of fraud.

Mark explained the process of selling the company. I did not think that I got $300 worth of advice out of the meeting. I just had to hope that he would be worth the money when the exchange of paperwork got more intense. I am pretty sure that we provided Mark with a copy of the Letter of Intent. I don’t recall whether he had asked us if Tim had said in writing that he had lined up sources for the financing.

On May 20 Tim sent me forty-one “due diligence” questions. They are posted here. I wrote up answers, and Mark reviewed them. I then sent them to Tim together with the necessary attachments on May 24. The answers are posted here. Bring a lunch; it has eleven pages and several attachments that I did not post.

A second set of twenty-one questions came on May 28. They are posted here. My answers and supporting documentation was sent on June 2. They are posted here.

The third set of ten questions arrived on June 17. These, which were more personal than technical, are posted here. By this time I was getting very antsy about whether this process could be completed before Sue and I departed for our vacation in Russia. The file of answers has the same date and is posted here. Since all my answers were reviewed by Mark or his staff, one of the dates must be wrong.

I remember one after-hours telephone call that I had with Tim. I have always hated telephone calls, and I had been spending an inordinate amount of time writing up very detailed answers to his questions. He told me that I sounded like I had “seller’s remorse”. I explained that what he heard in my voice was my lifelong aversion to negotiating over the phone.

On Thursday, August 5, Tim finally sent to me and Mark the purchase agreement (here), promissory note (here), stock pledge (here), and employment agreement (here). I immediately called Mark’s office and left word that I was leaving for vacation on Sunday and would be back in the office on Monday, August 23. Nothing was to be done until they heard from me. I asked Denise to keep me apprised of any developments, but I warned her that I was not confident about how reliable my access to the Internet would be.

The documents were long and complicated. However, they appeared to my untrained eyes as pretty much in accord with the LOI. My obligation, which previously had consisted of a definite two-year commitment and another tentative two-year commitment had been changed to a definite three-year commitment.

Russia: For many months Sue and I had been planning to take a river cruise in August in Russia from St. Petersburg to Moscow (described in great detail here). Because the arrangements had been made in conjunction with our friends, Tom and Patti Corcoran, postponing the trip was never a serious consideration. I had put in a lot of effort to get the most out of the trip including spending a lot of time trying to remember the Russian that I had learned in the sixties. I even downloaded a set of flash cards for Russian vocabulary from the Internet. I used them for at least an hour per day.

I was very excited about the prospect of seeing both the major cities of Russia as well as a little bit of the vast territory between them. I was happy that the deal with Tim seemed to be nearing consummation, but I did not like the fact that I would be on a ship in Russia while the unsigned documents were in Hartford and St. Louis.

On day #11 of the cruise, Thursday, August 19, our ship. the Viking Surkov, was docked on the northern edge of Moscow. I was scheduled to take a bus tour to Sergiev Posad, which had been outrageously described to us as the Vatican City of the Russian Orthodox Church. Before breakfast I had made my way to the center of the ship, where the Internet service was the closest to tolerable. My journal has only this brief description: “I had just enough time to download my e-mail messages. A couple of the work-related ones were rather disturbing, but there was not much that I could do about them.”

The disturbing messages were from Denise. Evidently Tim’s lawyers had been communicating with Mark about details of the agreement throughout my absence. That was disturbing enough, but Tim himself had contacted Denise and had told her that his bankers had been questioning some aspects of the deal. He wanted to rewrite the purchase agreement. I was astounded to learn that the bankers were still involved. I thought that surely he must have shown his plans to them before he sent them to the lawyers and then to us. What in the world was going on?

Tim’s new plan: I don’t have any documentation of the new plan that I had to deal with when I returned to work, but I am pretty sure that I remember it in some detail. He proposed to buy only Denise’s 25 percent of the shares immediately. Sue and I would still be majority owners. I would hire him as marketing director at a salary of $50,000 per year. In three years he would buy the remaining shares if we had met the sales objectives that we had outlined. They are posted here.

I considered this proposal laughable:

- Sue and I received nothing.

- Since the business was not being sold, Steve Pope received nothing except salary cuts.

- He wanted me to let my most valuable employee go and voluntarily terminate a relationship that I had worked hard to cultivate.

- My new partner would be someone with whom I was dreading working.

- TSI’s new marketing director had no credentials and no ties to either of our target markets.

- He wanted to set his own hours and work from home.

- If (actually when) the plan failed, it was still my responsibility.

- Sue would kill me if I agreed to this.

I tried to explain why this was a non-starter. I don’t think that Denise would have agreed anyway, but our agreement with her prohibited her from selling her shares privately.

I made one more trip to St. Louis to try to persuade him. Denise thought that it was a waste of time and money, and so I had to pay for it myself. Tim picked me up at the airport in his snazzy Lexus sports car and drove us to his house/office in Chesterfield, MO. I tried to resurrect his original proposal with every argument that I could think of. He listened to me politely and said that he would think about it, but I knew that the deal was dead.

I wrote a letter terminating our contract with Mark as soon as I returned. Here is the text:

Please terminate our contract immediately. At this point, it appears that the deal is beyond resuscitation. If this transaction is somehow revived, we may want to start anew.

Thank you for your assistance. It is a shame that so much effort was wasted on such a futile endeavor.

Explanation and Speculation: Here is what I think might have happened. The banker(s) were probably not impressed with his idea. However, they must not have rejected it out of hand because he was still willing to buy out Denise. So, he must have been able to lay his hands on $250,000. I think that they probably were asking him to put up his house or some other fixed asset as collateral for the rest of the money. Either this gave him cold feet, or perhaps his wife put her foot down. In either case I blame the feet.

Could this gigantic SNAFU been avoided? I think so. I should have insisted that Tim show the Letter of Intent to the bankers. He had allegedly already bought and sold companies. I assumed that he would have lined up financing first before telling someone that he wanted to give them $1 million. Like Fllounder in Animal House, I fucked up; I trusted him.

Would the original plan have worked? It would only have worked if Tim had been able to convince two or three large retailers to buy AdDept. At that point the only ones left who did not use AdDept and also did a lot of advertising were Walmart, Home Depot, Lowe’s. Dillard’s, and chains of grocery stores and drug stores. Maybe he could have pulled it off, but I cannot imagine how. Maybe he knew how to persuade them to let me talk with the advertising managers and then give a presentation, but I had seen no evidence of it.

At the same time we probably would have needed to pivot our development to use more attractive input and output. We also probably would have needed to come up with a way to handle Internet advertising in a useful manner. Both of these tasks would be daunting.

Even if we had succeeded, I think that my life would have been hell for three years. I was absolutely and completely honest in everything that I said to him, but there were certainly things that he did not understand. For example, I seriously doubt that he understood that the AxN revenue was dependent on the AdDept clients. When an AdDept client stopped using the system, was purchased or absorbed by another retailer, or outsourced the buying of its newspaper ads, all or at least a majority of the associated AxN revenue disappeared.

Denise, who was ten years younger than I was, wanted to sell because she desired to try something else. I had no such ambitions. I wanted to sell because I could not see a way to make the business continue to be viable without a huge expenditure of time and money.

I would have done everything that I could to make it succeed, including going back to working 70-hour weeks. It would have required a herculean effort to make the business work without Denise. Keep in mind that I had celebrated my sixty-second birthday on the ship in Russia. Whom could I hire to replace Denise? I could probably find someone with the experience and skill of the Denise whom we hired in 1984, but no one in the U.S. could just take her chair and do what she was doing in 2010 without a lot of on-the-job training. My rule of thumb was that new programmers generally cost me more time than they saved during the first six months of employment, and Denise meant much more to the company than any programmer.

I would not have taken any vacations during those three years. That means that I would have missed the South Italy tour in 2011 (described here), which was our last tragic adventure with Patti and Tom. In 2012 we took a Larry Cohen bridge cruise, the famous honeymoon for one (described here). I would never have met Frank Evangelista. In 2013 I spent a few days at the Gatlinburg Regional bridge tournament with Michael Dworetsky (describe here). A lot of pleasant memories would have never been created.

Worst of all, I think that Tim would have inevitably come to blame me for the company’s failure. I can imagine awkward and even painful telephone conversations on a weekly basis. I don’t know what he would have tried to make me do to fix the situation. You can’t squeeze blood from a stone. He might have sued me. I cannot imagine what the grounds would have been, but he probably had much deeper pockets for legal fees than I did. For a guy like me that would have been a real nightmare.

Expenses: Denise and I spent a lot of money, and I took on more than 75 percent of the cost. We spent $24,000 for Steve Pope’s activities. I don’t remember what the appraiser charged, but it was much more than $1,000. Mark charged us at least $12,800. The trip to St. Louis cost $500, and our dinner with Tim was nearly $150. So, the total charge was around $40,000. I also spent a great deal of time on this project, and at the time we were billing out my services at the rate of $1,000 per day.

This was not quite as bad as it looked. The expenses were deductible, and at the time I was paying a lot in taxes. Furthermore, if the effort had been successful, Sue and I would have received hundreds of thousands of dollars. In 2009 I invested a high percentage of my savings in an indexed fund based on the S&P 500. I would presumably have augmented that with an even higher percentage of the windfall. From that time through October of 2023 the S&P 500 has increased in value by approximately 300 percent! Do the math.

1. Steve Pope was still in the business brokerage business in 2023. His company was called Pope and Associates, LLC. The website is here.

2. Mr. Gunville’s LinkedIn profile is here.

3. Mr. Dustin’s LinkedIn profile is posted here. FRG’s website can be viewed here.

4. M&F’s website can be found here.

5. NAS’s website is here. Mr. Lerner’s LinkedIn page is here.

6. Several companies called the Catalyst Group existed in 2023, but I don’t think that any were the people to whom I sent the letter.

7. Corum’s website is here.

8. VR’s website is here. Mr. Capozzi’s LinkedIn page (posted here) indicated that he owned a VR franchise.

9. George Abraham’s LinkedIn page is here.

10. For a short while I placed the most current TSI backup tape in the P.O. box. The clerk quickly put an end to that. He said that it was not allowed for the owner of the box to put anything in it. The owner could take things out or leave them in the box, but only post office employees could place anything in the box. I did not argue. I think they were worried about a bomb.

11. Tim Finney’s LinkedIn page lists his occupation as CEO and Founder. It is located here.

12. Webex is an Internet product from Cisco systems. It allowed people to view on their own systems what was being displayed on remote systems. This was, of course, before Zoom existed.