One magic summer. Continue reading

By the spring of 1975 both Sue and I missed our friends back in Connecticut. From Michigan I got in touch with someone, probably Scott Otermat, at the Hartford to see if I could obtain employment there for the summer. The Individual Pensions Department was happy to have me back, and they paid me pretty well.

Sue also contacted her last employer in Hartford, the Little Aetna, and she was also able to obtain a temporary position with them.

The second semester at U-M ended in late April. Sue was between jobs. So, early in May we loaded up both cars with our clothes and other necessities, and we also brought Puca in his cage. I don’t remember anything about the trip. We certainly drove through Ohio and Pennsylvania. We did not encounter any memorable difficulties.

We did not sublet our apartment in Plymouth. I don’t think that we even discussed it. Even paying two rents, we calculated that we would do a lot better economically than if we had remained in Plymouth and sat on our thumbs.

We probably stayed at least one night in the Hartford area before we found a furnished apartment. Sue’s family might have put us up. I don’t remember that we made any other arrangements. We found a very convenient place on Wethersfield Avenue in the south end of Hartford. There were quite a few apartment buildings there. Ours had a parking lot in the back.

Work: Sue did not talk much about her work at the Little Aetna before we left Connecticut, and I don’t remember her talking about it much during the summer of 1975 either.

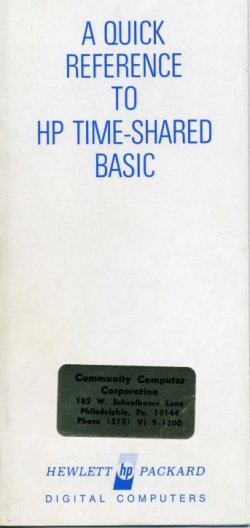

I was welcomed back to the twenty-first floor by many smiling faces. I was assigned a desk right in the middle of the Individual Pensions department and provided with a teletype terminal right on my desk. It differed from the two in the computer room in two ways: 1) Its off-line storage device was film tape cassettes rather than paper tape. It could read and write much faster; 2) It was quiet enough that it did not disturb nearby employees. The ones in the computer room were very noisy.

I undertook some programming projects on the HP 3000, but I don’t remember any details. I had had no association with computers in the eight months that I had been gone, but it did not take me long to feel comfortable again. I was only twenty-seven years old; my memory still worked.

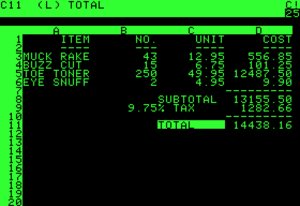

The big project for the summer involved Paul Gewirtz, who was by then a Fellow of the Society of Actuaries, Scott Otermat, me, and a few people from the Data Processing Department. Our department wanted DP to do a project on the mainframe. I am not certain, but we may have wanted them to replace the very flawed system that was still being used to produce the annual reports for the policyholders.It is described here.

Scott, Paul, and I met a few times before we talked to the people from DP. We had our needs already outlined on paper including the formulas for the calculations. We had laid out what data the entry screens had to collect. We gathered samples of the output from Carolyn DesRochers’s area.

I have been in a hundred or more such meetings. In subsequent years I was on the other side of the table. That is, people were explaining to me what they wanted the computing system to do for them. Only one or two of those requests were as well documented as ours was at the first meeting.

DP assigned two people to our project, one female and one male. The woman had some experience. It was, I think, the first project for the guy. In the first meeting we did not get as far as showing them the materials that we assembled. We first had to explain to them what individual pensions were and how they were handled at the Hartford. The only thing that the committee agreed upon at the end of our first meeting, which lasted for a couple of hours, was that we needed more meetings.

After that we met weekly, I think on Tuesdays. The three of us continued to do almost all of the talking. After five or six weeks of this, the DP lady informed us that we needed to do a presentation for one of the vice-presidents to evaluate the project. We were happy to hear this. Although we were disgusted by all the time that we had already put into the project, it seemed as if it was beginning to roll.

The DP lady assigned aspects of the presentation to each of us. I don’t remember who played which role. We even had a rehearsal. The meeting attended by veep was not that memorable either. We gave out little talks. The DP guy asked a couple of questions. We all shook hands and went back to work.

A few days later Paul or Scott heard from the DP lady that the presentation had been favorably received. She also said that we would meet the next Tuesday to begin the next stage. She wanted all three of us to attend. Paul, for one, did not see why his presence was still required, but he came anyway.

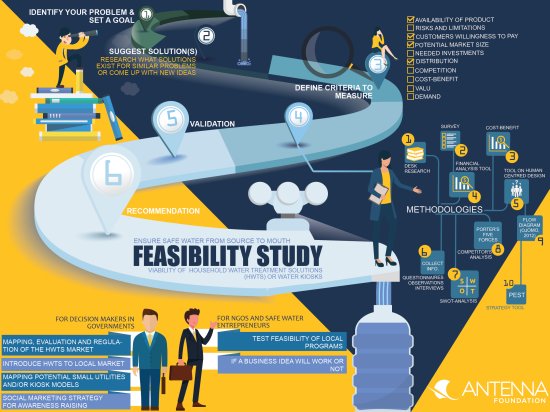

That meeting was a real eye-opener for all three of us. The DP woman announced that we needed to put together information to justify that our project was worthy of a feasibility study that would be conducted by a different group of people from the DP department. The three of us from pensions were gobsmacked. We told her that we thought that our committee had been doing a feasibility study. That was why our documentation was so detailed. If we were not assessing the feasibility, what had we been doing? Furthermore, if the VP was not assessing the feasibility of our request, what was he doing?

She said that the VP from the DP department was impressed with what we had done. It was an easy decision for him to proceed with the project. She may have understood how little this praise meant to us, but she insisted that the next step was definitely to request a feasibility study and make a separate presentation. We had to be prepared to meet the department’s standards for such a request. After some more venting of our frustration we scheduled another meeting.

Paul, Scott, and I met the next day. Paul had just one question for me: “Could you write this code?”

I said that the coding would not be that difficult. However, if we used the HP 3000, the data entry on teletypes (as opposed to mainframe terminals or coding sheets keyed in elsewhere) would be kludgy, and I had no access to a printer capable of producing the output.

At the next meeting Paul swept aside the agenda provided by the female DP employee and said that he wanted to consider another approach. He wanted to know if it were possible for a few people from our department to be given a portion of the disk and whatever other resources were needed to produce the required output. He emphasized, “Data processing would not need to do any of the system design or programming. We just need access to the machine and a programming language that we can use.”

This was, of course, out of the question. She would not even ask her bosses if that was a possible approach. We needed to go through the established protocols. That ended the meeting.

When he got back to Individual Pensions Paul called one of the officers in the DP department and informed him that our department was dropping the request. I don’t know if anything was ever done about this.

Sports: If there was a Mean Reserves softball team in 1975, I don’t remember whether I played or not. I do remember playing in a few practices. My kneecap felt fine. I may have lost a step on the basepaths, but there was no pain. The biggest problem was that I seemed to have lost my league-leading swing. I felt as if I was swinging the same. I could still direct the ball to right field, but I could no longer consistently hit line drives. I found this very frustrating.

I also remember one practice softball game in which, for whatever reason, I was playing shortstop without a glove. Someone hit a line drive over my head and to my left. I leapt toward it and extended my bare left hand. I stopped its flight long enough that I was able to catch it with both hands before it hit the ground. It was a spectacular play.

I also remember that I was playing left field once when there was a man on third with one out. The batter hit a fly down the third base line. I caught the ball on the run and immediately threw it toward the catcher as hard as I possibly could. As I had anticipated, the man on third tagged up and tested my rag arm. The ball reached the catcher in time, but something went wrong. I don’t remember what.

So, my Hartford softball career ended with my perfect record of never having thrown out a runner intact.

John Sigler and Jim Cochran continued their golf partnership. One week I substituted for Jim in the Men’s League. I was matched up against a guy whom I had narrowly defeated in a very tough match the year before. I had to give him one stroke this time, which was not at all reflective of our abilities in 1975. He was at the top of his game, and I had played little or no golf since breaking my kneecap a year earlier.

The first hole was a medium-length par four. My opponent hit a nice drive and a good iron shot. He had a long putt for a birdie. Meanwhile I was spraying the ball from the rough on one side of the fairway to the other. After four miserable shots my ball was on the fringe perhaps a foot from the green. I decided to putt, and I stroked the most memorable shot of my entire golf career. The ball rolled and rolled and then dove into the hole.

This fluky shot seemed to ruin my opponent’s composure. He three-putted, which meant that we halved the hole. Thereafter, he played better than I did, but only by a little. I lost a couple of holes badly, but, even though I had to give a stroke, I also won a couple of holes on which he made mistakes. We ended up tying the match. John won his match, and we won the team match to earn 2.5 out of three points.

I played a few rounds of golf on weekends with John and Norm Newfield, but I don’t think that I played very well. I remember thinking that my athletic prowess, such as it was, reached its zenith the day that I broke my kneecap during the previous summer.

Other: I have few other distinct memories of the summer. I remember cooling off with gin and tonics. The apartment did not have air conditioning. I knew no one in Connecticut who had air conditioning until years later.

Jim Hawke and I became good friends that summer. We ate lunch together most days. Occasionally we went out to a nearby restaurant.

There were two negative and bizarre notes. One morning I placed my wallet in the inside coat pocket of my brown corduroy jacket. I walked out to Greenie, parked as always in the apartment’s lot. I opened the car door, took off my jacket, and tossed it on the passenger seat.

When I arrived at the Hartford I seized my jacket and, before I even put it on, I noticed that the wallet was missing. I searched the car and found nothing. I immediately drove back to the apartment. It only took about ten minutes. I searched the parking lot and retraced my steps to the apartment. I never found it.

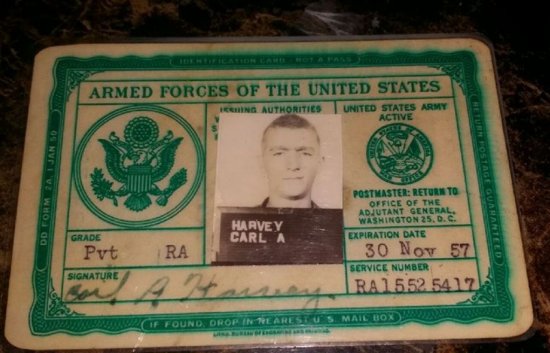

There was not much money in it, and I did not have any credit cards. I had to replace my driver’s license, of course, but the biggest loss was my green military ID card. On it was the only extant picture of me with the ultra-short military Class A haircut. Sue said that I looked like a convict in that picture.

One evening while I was driving from work to the apartment my back began to itch. It soon became almost more than I could bear. Then I began to feel feverish and weak. It was, thank goodness, only a short drive.

Once inside I peeled off my coat and shirt and looked at my back in the bathroom mirror. Apparently a spider or an insect of some sort had somehow gotten in my shirt. There were a dozen or so bites. I searched through my clothing, but I did not encounter my assailant.

I took a shower, lay down, and immediately fell asleep. I awoke an hour or so later, and I felt better. By the next day I was fine.